These are profit rates, not total profit. When the rate falls that doesn’t actually mean the economy has shrunk, that just means the economy isn’t growing as fast. Acceleration vs Velocity, get it?

deleted by creator

GDP is a measure of all economic activity. It’s a bit more complex than this, but imagine it’s a running count of all money that’s exchanged hands in a country over a specific time. So even if a sale is made and the seller loses money, there has been an economic activity which can be counted.

The stock market is less related to actual profits and more a betting arena on potential profits. It’s also artificially inflated with money being created from nowhere and plugged right into the stock market, as well as stock buybacks and pure speculation driving up the prices of some things.

In 2013, the United States’ Bureau of Economic Analysis changed the methodology for how GDP was calculated. R&D and intellectual property were reclassified as investments rather than costs, which increased the reported size of US GDP. Countries that had more high-tech and creative industries would see a boost in GDP while countries known for manufacturing would not see such a large increase. This lead to a perception that the U.S. economy is growing faster or is larger compared to countries like China.

GDP is about values of goods exchanged, it doesn’t care about the margin either party has on the exchange. For stock market, rate of profit would influence dividends rather than market valuations. Dividends are in principle a part of evaluating stock prices, but aren’t necessarily directly deterministic of stock prices. Also, it is possible for companies to ibcrease profits and also increase their values while their rate of profit drops anyway.

Because profits and the rate of profits aren’t the same thing.

As long as capital is being reproduced it can be pumped into the stock market. For GDP, note how the rate of growth has declined and in countries that were early to have capitalism (germany) it’s inverting. The absolute mass of capital continues to grow, just at a lower rate, until there’s nowhere to invest anymore.

Stock market is purely vibes-based

GDP is just the total estimated currency value of goods/services produced in a place during a time frame. I don’t think they even need to be sold, just available for purchase.

Falling rate doesn’t have to mean negative profits. Crude example: If you made $15.00/hr at work and work 30 hours one week but make $15.00/hr at work and work 25 hours the next week, you’re still making money but you’ve made less. For a business, it can just mean that last year Profits were 10% and this year Profits are 9%. The business is still making money, still generating profits just less than it was before.

Stock Market prices are just made up numbers with, at best, only a very loose connection to what a business is doing or how well its doing it. Literally just “vibes”.

You’re measuring a profit rate vs a dollar count.

GDP is going down https://www.shadowstats.com/alternate_data/gross-domestic-product-charts

just to note and think about:

1st: maybe profits are the stories what companies make up for tax offices and thus they shrink constantly just to pay less, nowadays often due to “licenses” beeing payed to same-company-substructures that are then taxed in tax-havens at a fixed shamingly low rate per year no matter how much it actually was.

2nd: maybe managers pay themselves huge boni for enabling the company to save huge amounts of taxes (see 1st above), thus average (not median) income rises (not asked in the question though)

3rd: maybe banks print more money for richies to let you work for basically free for them, thus things get overall more pricy thus gdp rises.

4th: maybe its economists “job” to come up with complex artificial stories and mathmatical calculations to make governments and “you” believe that you actually “profit” from beeing ripped off. (not asked for this answer too, but is included in the answer however)

maybe, just maybe ;-)

1 I think this can be verified for all public companies.

2 Corporations are taxed at a lower rate than individuals. Individual managers and CEOs are often paid in stock options which is buying stock from the corporation at a below market rate and selling the stock on the market for a normal price. For this they pay a 15% flat tax.

3 Sorry but its worse than that. Many major corporations are price fixing. https://goodjobsfirst.org/illegal-corporate-price-fixing-conspiracies-are-widespread-in-u-s-economy/ That certainly helps GDP go up.

4 I don’t have an issue with the math, its often with the definitions and how they are collecting information that gives those paying for the studies a means to justify what they are already doing.

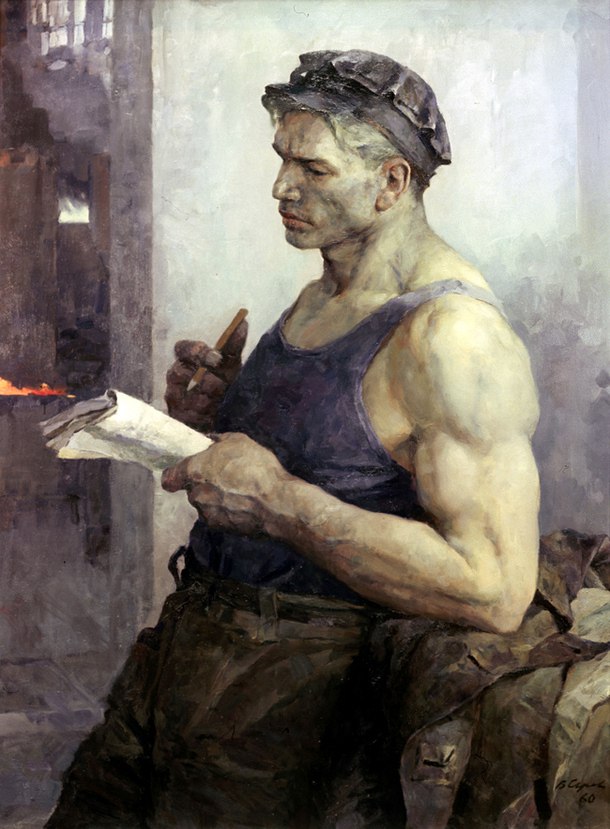

Assuming perfect labour theory of value, profit = size of working population producing surplus/ value of capital stock.

Given a constant size of the former and a positive accumulation rate, the value of capital stock goes up and the profit rate will eventually approach 0.

This is independent of whatever happens with the gdp, which is proportional to the size of the whole working population.

deleted by creator

That’s not really how GDP works at all. Financial transactions (Exchanging money, giving change, buying stocks, buying bonds), transfer payments, and unreported transactions are not counted as part of the GDP calculation.

GDP counts products produced. Not money spent.

Doesn’t GDP also count services rendered?

Yes, but the service must be listed for sale for an express price. Simply exchanging money doesn’t fall into this category, doubley so if you’re not enhancing the money with a business.

If you trade US Dollars for Euros at an airport bank for example, the amount of money that you exchange will not be counted in GDP, as the money cannot be attributed to an express service or product; however, the commission or fee that the bank takes will be counted, because that is an advertised service rendered for a given price.

Ok, then I have written drivel. Thanks for clearing that up!

No problem! Happy to help! No shame in learning! :)

Reminds me of looking at the TRPF wiki and they cite some random economists coping about it being wrong. Explain this simple graph then “Doctor”.