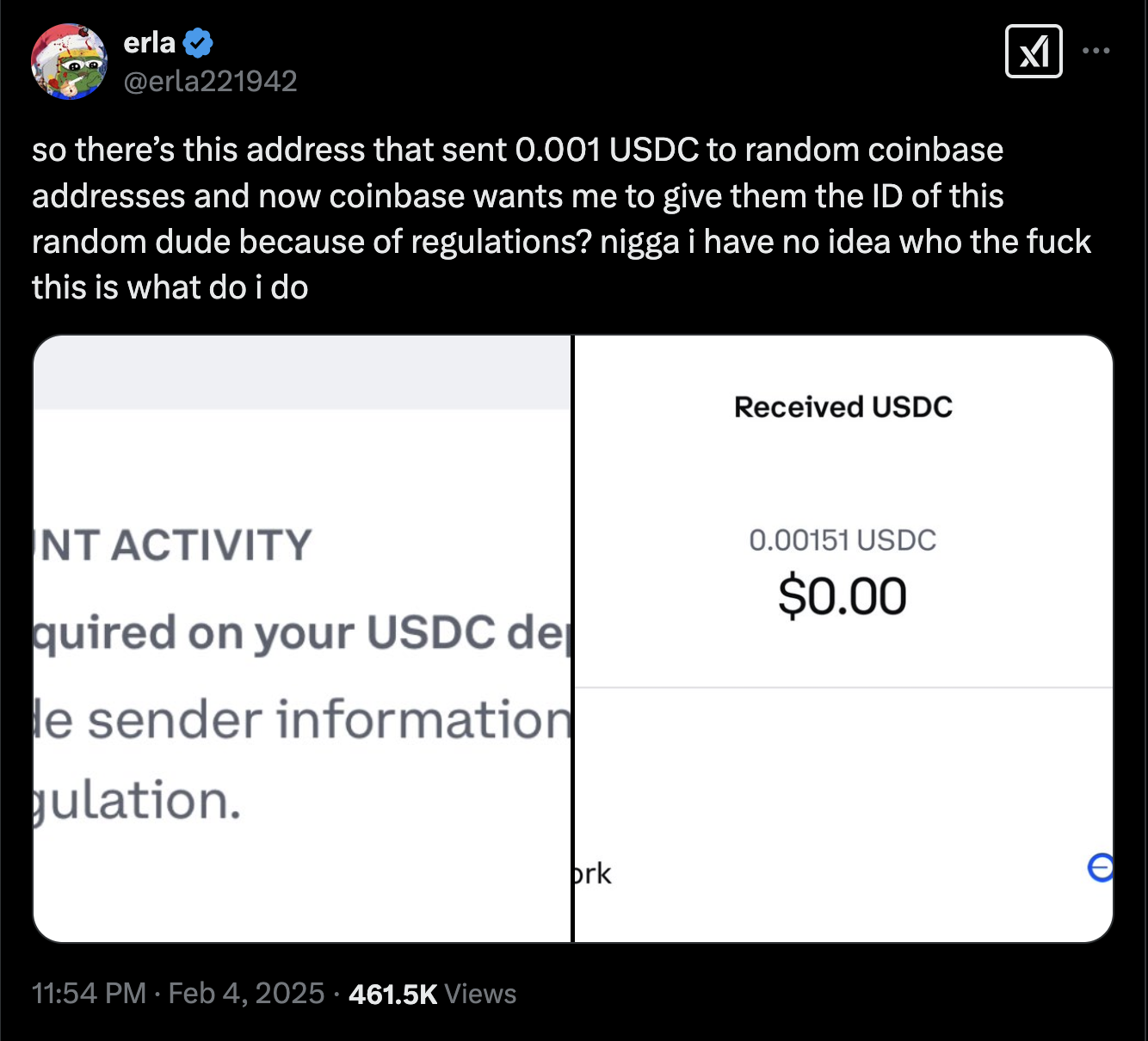

This week on “Unexpected Downsides To #Cryptocurrency”:

Did you realize that you can’t reject #blockchain transactions and therefore anyone who wants to harass you can more or less freeze your “bank account” at an exchange like #Coinbase instantly just by either:

a) sending a euro through a sanctioned mixer service like #TornadoCash before sending it to you or

b) sending a few cents to a sanctioned terrorist wallet before sending you a single cent

The automated systems used by Coinbase will immediately notice that you have interacted with suspicious or sanctioned wallets and Coinbase, which, like all crypto companies, spends as little as possible on customer support, will lock your account until you produce a passport for the person who sent you that tiny amount of money (often for months).

These so called “dust attacks” constitute revolutionary new vectors in harassment.

sounds like a cheap way to mess with crypto scammers, anybody got a spreadsheet?

Well, if I had more time, this would absolutely become my new favorite hobby.

Also, if I was willing to buy crypto, which I’m not.

Wait, the dusting attack problem has not been fixed?

It will be fixed in the next 18 months bro. Don’t worry bro.

so like one-half-thousand days

So they need Altman to build his AGI first?

This is actually good for bitcoin bro. You just aren’t looking at the bigger picture bro. The market will correct bro.

Michel is great and you should follow him if you enjoy crypto shenanigans

I’m guessing you still have the problem of getting even a little bit of dust into a ‘clean’ wallet to make sure you don’t get any direct links back to you, though. Whether that comes in the form of your own wallet/account getting shut down for the same flag or getting on some financial compliance radar for the same shenanigans that your victim is getting linked to.

If you don’t share your wallet codes or coinbase username I’m guessing you’re safe from this?

Prob yes, yes unless you reused your account name or they just randomly spray these dusting attacks.

Not your keys; Not your coins.

not your peepee not your poopoo

What a snappy slogan. Did you come up with it all by yourself?

No, I’m not really well versed in crypto. A friend of mine that works in offensive security mentioned this to me. Basically with how the algorithms behind cryptocurrency work, and with how the legal process works, you don’t have control over any of your coins nor do you have legal avenues to correct any wrongdoing, nor does any human power or agency have the ability to forcibly correct actions taken by bad actirs. You MUST treat crypto like cash in a mattress and do everything yourself, anything else is a security theater facade.

I see. You should maybe know that while it’s true in a sense, a lot of people don’t like that phrase very much. It’s a cliché cryptocurrency fans recite in response to any issues with cryptocurrency exchanges and I among others feel it serves to downplay the responsibility of the exchanges and blame the victims.

Securely taking care of an offline crypto wallet is somewhat more complicated and technically involved than just having an account on an exchange site. That the easiest way to use cryptocurrency is also an insecure one speaks of a major usability problem in the whole ecosystem.

More importantly, exchange sites offer what is essentially a bank account with little of the accountability of an actual bank. If a bank gets hacked and loses all your money or freezes your account for frivolous reasons, people generally don’t go “well you should have stored your money in cash inside your mattress instead”. (I guess some do, but they deservedly get the stink eye from people in polite society)

I dislike cryptocurrencies and have little trouble having vindictive schadenfreude when coiners and their platforms keep being embarrassed time and time again, but I know the real problem are the corporations and the tycoons, so I don’t like their responsibility being shifted on the least informed and most vulnerable group of retail users, who are also the most likely ones to use these exchange platforms and thereby not hold their own keys.

the least informed and most vulnerable group of retail users, who are also the most likely ones to use these exchange platforms and thereby not hold their own keys.

While that’s true, I think that group of users are mainly speculators, not people interested in using it as a currency. And most criticism I’ve seen about crypto (at least when comparing it to fiat) is that it’s too volatile to be a useful currency, and the volatility is driven by speculation. So I don’t think they’re as innocent as you said, even if they are uninformed.

Not at all innocent, no. But I’d rather see the exchanges suffer than the small fry retail speculators (though I can still laugh at them).

deleted by creator

deleted by creator

Inb4 people go on a rant about cryptocurrency

inb4 people do exactly the thing this subsection of this website is intended for

Apparently they were out-b4 I could even see what they wrote.

I’ll respect their decision to voluntarily retract their crypto apologetics and not bore you with it. Just a bit funny to pre-empt anti-crypto rants on a forum called Buttcoin on a site called Awful Systems.

deleted by creator

do you even know where the fuck you’re posting

deleted by creator

it’s fucking weird you made an account just to post this tripe, but off you fuck anyway